- The BlockStreet Journal

- Posts

- BTC Needs Liquidity To Breakout

BTC Needs Liquidity To Breakout

PLUS: SEC May Get Stiffed By Terra Luna

Blockstreet Journal

In Partnership With:

Welcome, Crypto enthusiasts!

Bitcoin has been pumping and dumping in a narrow range for months, and that is almost over as new liquidity is being raised.

In Today’s Blockstreet Journal:

BTC Needs Liquidity To Breakout

SEC May Get Stiffed By Terra Luna

Market Rundown

Top Gainers & Losers

Airdrops More News

Latest News

BITCOIN

💰️ BTC Needs Liquidity To Breakout

Word On The Street: Bitcoin bears have been selling at every rally over the past few months, but analysts believe that a liquidity boost driven by BTC reaching new all-time highs could break this cycle.

The details:

Bitcoin bulls might soon see this liquidity, as MicroStrategy, the largest corporate BTC holder, announced its intention to raise $500 million.

In the previous cycle, there was a 21-day consolidation period before Bitcoin’s price broke out, eventually reaching an all-time high.

Data from market intelligence firm IntoTheBlock shows IOMAP model reveals the price is currently between two significant levels.

Why it matters: There is strong support around the $63,500 to $67,500 demand zone, where approximately 1.62 million BTC were previously bought by 3.94 million addresses.

SPONSORED BY COINLEDGER

🏦 Afraid of crypto taxes?

Word On The Street: CoinLedger offers a suite of products designed to aid cryptocurrency enthusiasts on their investing journey. We know that trying to do your crypto taxes can feel overwhelming and confusing. CoinLedger was designed to be a stress-free product for any crypto investor.

The details:

Import your crypto transactions from your wallets and exchanges.

Watch the platform calculate your gains and losses for all your transactions — trading, staking, NFTs, or anything else!

Once you view your transaction history, download your tax report with the click of a button.

Just use this exclusive link to make crypto taxes easy!

MARKET NEWS

🌕️ SEC May Get Stiffed By Terra

Word On The Street: The SEC might receive only a fraction of its multibillion-dollar settlement with Terraform Labs.

The details:

Terraform had assets valued at $430.1 million and liabilities of $450.9 million in January when the firm filed for bankruptcy.

On June 12, Terraform Labs agreed to pay the SEC approximately $4.47 billion as part of a settlement.

This includes disgorgement fines of around $3.6 billion, a civil penalty of $420 million, and prejudgment interest of nearly $467 million.

Why it matters: Despite the low probability of receiving funds, the SEC has portrayed the settlement as a significant penalty.

Market Rundown

Fear & Greed Index

The global crypto market cap is $2.44T, a 0.87% decrease over the last day.

The total crypto market volume over the last 24 hours is $65.66B, which makes a 23.86% decrease. The total volume in DeFi is currently $5B, 7.61% of the total crypto market 24-hour volume. The volume of all stable coins is now $61.23B, which is 93.24% of the total crypto market 24-hour volume.

Bitcoin’s dominance is currently 54.20%, a decrease of 0.16% over the day.

Global Market Metrics

The current state of the cryptocurrency market is as follows:

- Total Market Cap: $2.44 trillion

- 24-Hour Volume: $65.66 billion

- Number of Active Cryptocurrencies: 10,103

- Bitcoin Dominance: 54.20%

- Ethereum Dominance: 17.27%

DeFi Market:

- Market Cap: $83.61 billion

- 24-Hour Volume: $5 billion

Stablecoins:

- Market Cap: $155.01 billion

- 24-Hour Volume: $61.23 billion

Derivatives:

- 24-Hour Volume: $531.68 billion

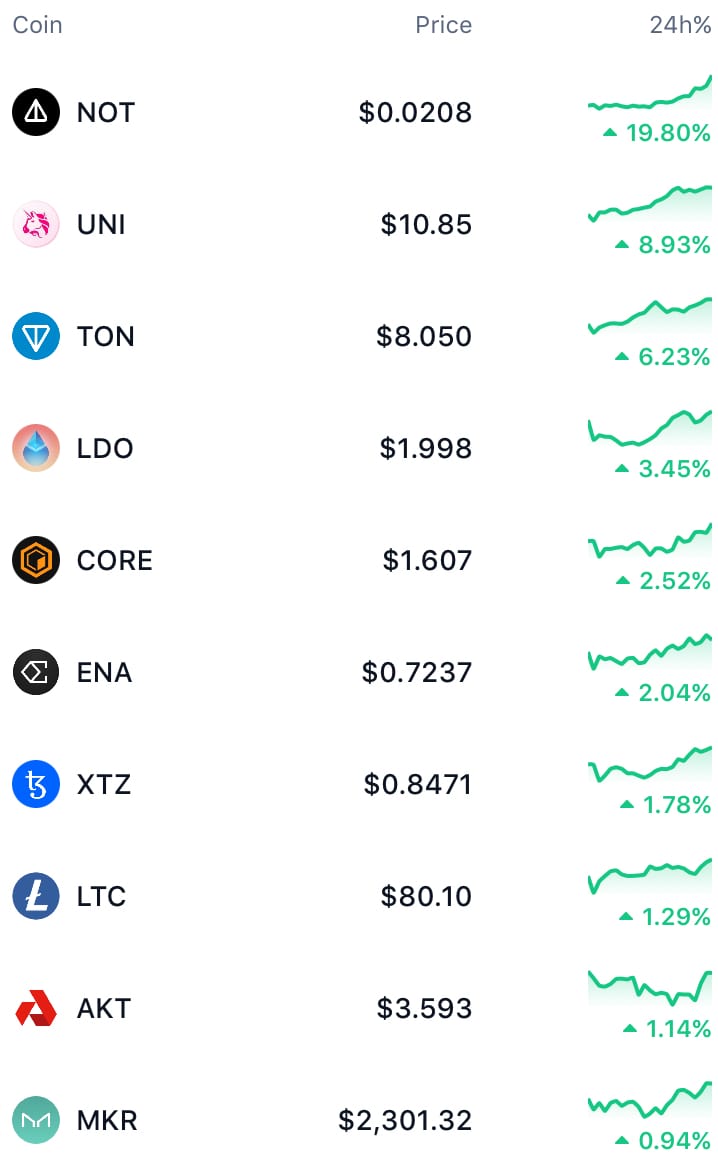

Top Gainers & Losers

🚀 Top Gainers

💩 Top Losers

Airdrops & More News

DAILY AIRDROP

📦️ deBridge Stake Airdrop

deBridge has raised $5.5M in funding from investors like Animoca Brands and ParaFi Capital and has also launched a points campaign. Users who make swaps on their cross-chain bridge can earn points based on their volume. Also, earn 25% of the points from each referral. They have announced the launch of their governance token “DBR” and has allocated 20% of the total supply for community & launch. They’ve also confirmed to allocate an undisclosed percentage of the supply for “Genesis community airdrop”. Early users who use the bridge and collect points will get the airdrop when their token goes live. deBridge is also airdropping 1,000,000 ARB tokens to deBridge solvers and users of the deBridge app and of projects that have integrated with deBridge Widget, deBridge API and used deBridge infrastructure to bridge to/from Arbitrum

Step-by-Step Guide:

Visit the deBridge website.

Connect your wallet.

deBridge currently supports 11 blockchain networks such as Ethereum, Binance Smart Chain, and Polygon.

Now, make cross-chain swaps on deBridge and any partner application.

You will get 100 points for every $1 paid in fees to the deBridge protocol.

The more you bridge, the higher the points you will get.

Also, get 25% of the points from each referral.

Users who have previously used deBridge have earned bonus points based on their past activities.

For more information regarding the points campaign, see this tweet.

They have announced the launch of their governance token “DBR” and has allocated 20% of the total supply for community & launch.

They’ve also confirmed to allocate an undisclosed percentage of the supply for “Genesis community airdrop”.

Early users who use the bridge and collect points will likely get the airdrop when their token goes live.

deBridge has also launched the ARB Horizon campaign and is airdropping a 1,000,000 ARB grant received from the Arbitrum Foundation to deBridge users. It will be distributed over the course of 12 weeks to deBridge solvers and users of the deBridge app and projects that have integrated with deBridge Widget and deBridge API and used deBridge infrastructure to bridge to/from Arbitrum. For more information, see this article.

Other News

Protocol Village: Movement Labs Announces 'Battle of Olympus' Hackathon. The latest in blockchain tech upgrades, funding announcements and deals. For the period of June 13-19.

SEC chair sees spot Ether ETF S-1 approvals sometime in summer 2024. Some analysts had predicted that spot Ether ETFs could start trading on U.S. exchanges by the end of June, but the SEC has yet to set an exact date.

Swiss Regulator Shutters Crypto-Linked FlowBank, Begins Bankruptcy Process. FINMA announced Thursday that FlowBank’s minimum capital requirements were found to have been “significantly and seriously breached.”

BNB Chain to support early projects with new incubation alliance. The announcement comes amid a recent surge in BNB’s price, reaching a new all-time high of $717.48 on June 6.

🫡 Thanks For Reading

SPONSOR US

Get your product in front of over 10k+ Investors

Our newsletter is read by thousands of professionals, investors, developers, and business owners around the world. Get in touch today.

FEEDBACK

If you have specific feedback or anything interesting you’d like to share, please let us know by replying to this email.

Reply