- The BlockStreet Journal

- Posts

- Bitcoin Goes With China

Bitcoin Goes With China

PLUS: Analysis on PEPE, SUI & SHIB

Blockstreet Journal

In Partnership With:

Market Watch

Fear & Greed

Heatmap

Top Movers

🚀 Top Gainers

| 💩Top Losers |

Latest Updates

BITCOIN

🇨🇳 Bitcoin Goes With China

Word On The Street: Bitcoin surged to a new two-month high on September 27, following China’s latest economic stimulus measures that sent its stock markets soaring.

The details:

TradingView revealed that BTC/USD reached a local high of $66,194 on the Bitstamp exchange.

Bitcoin received an extra boost from China’s economic actions, which saw the Shanghai Composite Index experiencing its best week since 2008.

Despite a slight pullback from its recent high, Bitcoin continued to hold crucial support levels, maintaining stability around $65,000.

Why it matters: While Bitcoin is currently lacking a higher high to push through resistance, the market could see a surge if fear of missing out kicks in.

SPONSORED BY LEDGER

🔐 Keep Your Treasure Safe

Word On The Street: Hardware wallets store your private keys offline, giving you full control and enhanced security. Even if you misplace or lose your hardware wallet, you can get a new one and use your Secret Recovery Phrase to access your assets.

The details:

Buy crypto like Bitcoin, Ethereum and more by credit / debit card and bank transfer. Also, swap or cash out your preferred coins.

Get rewards by staking your ETH, SOL, ATOM, ADA and several other coins and tokens.

Keep track of your crypto and NFTs, browse a wide range of services and providers, and get the best deals!

Institution Holdings

Bitcoin ETFs

Ethereum ETFs

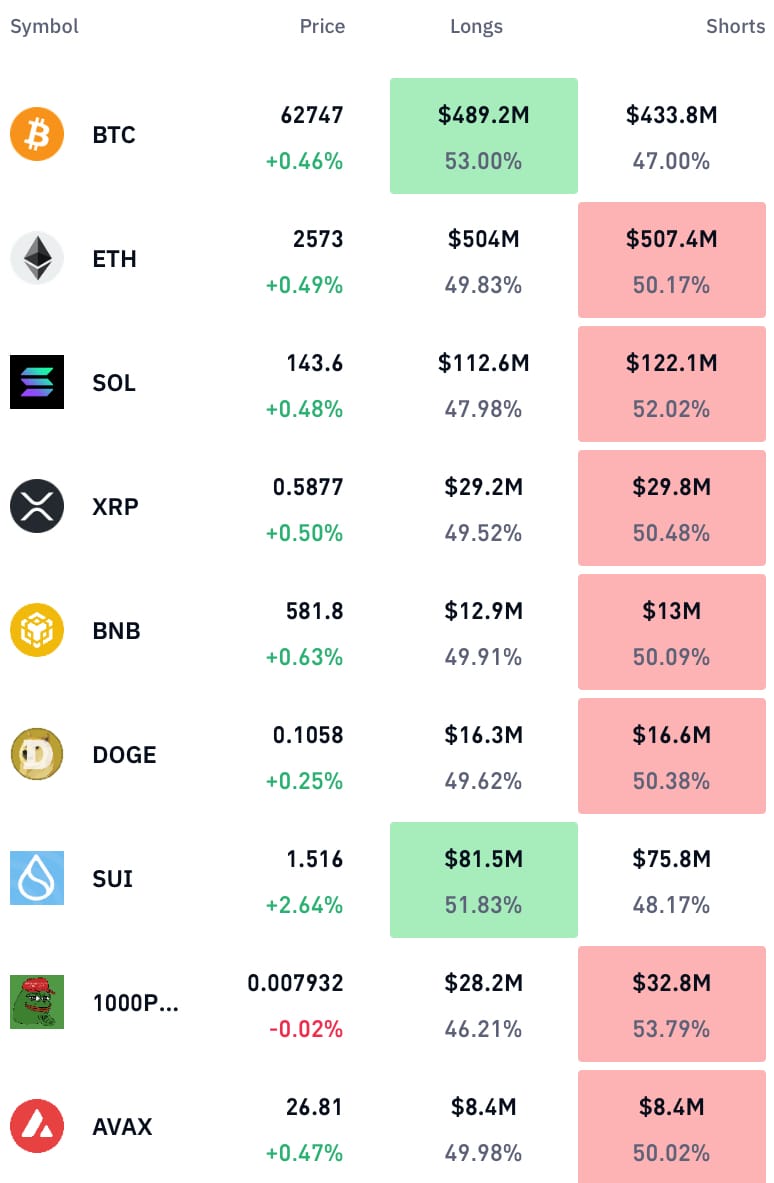

Longs & Shorts

Traders Corner (Premium)

Welcome, Traders!

Traders Corner is the premium section of The Blockstreet Journal. We provide one free report out of appreciation ❤️

Reports from our analysts today:

PEPE Technical Analysis (Free)

SUI Technical Analysis (Paid)

Shiba Inu Technical Analysis (Paid)

TRADERS CORNER

🐸 PEPE Technical Analysis

PEPE is trading around $0.000010771, slightly above the middle VWAP band at $0.000010558. This indicates a neutral to slightly bullish momentum as the price is currently hovering around the middle and upper VWAP bands, suggesting that buyers still have some control.

Trend Analysis:

The chart reveals a recent uptrend, with a sharp rally pushing PEPE above the upper VWAP band, accompanied by a significant increase in volume, indicating strong buying interest. Following the surge, the price has been consolidating near the upper VWAP band, which is a typical behavior after a sharp upward move.

The widening of the VWAP bands indicates increased volatility, which could signal that the market is preparing for a further directional move. The consolidation near the highs shows that bulls are maintaining their position but are currently encountering some resistance.

Support and Resistance:

- Resistance: The immediate resistance is near the recent high at $0.000010817. If PEPE manages to break above this level, the next target would be around $0.000011075.

- Support: The first key support level lies at the middle VWAP band around $0.000010558. If the price breaks below this level, the next support is at the lower VWAP band around $0.000010300.

Potential Scenarios:

Bullish: If PEPE maintains its position above the middle VWAP band and buying pressure resumes, it could retest the $0.000010817 resistance level. A break above this point could drive the price toward $0.000011075, signaling a potential continuation of the uptrend.

Bearish: If PEPE fails to hold its position near the current levels and breaks below the middle VWAP band at $0.000010558, the price could move toward the lower VWAP band at $0.000010300. A break below this support could signal a shift in sentiment, potentially leading to further downside.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Support What We do

- • Ad-Free Reading

- • Daily Technical Analysis Reports (M-F)

- • Price Locked (Protected From Future Price Increases)

Reply